A renewed buying pressure for the GBP is spreading between investors pushing EUR/GBP to the downside, while on the opposite side the GBP/USD continues to go up.

It is by now consolidated the fall of the EUR/GBP under the o.8000 level with the continuous selling pressures of the Euro currency which at the moment are pushing the cross to trade at 0,7913 making a negative performance of 0,09%.

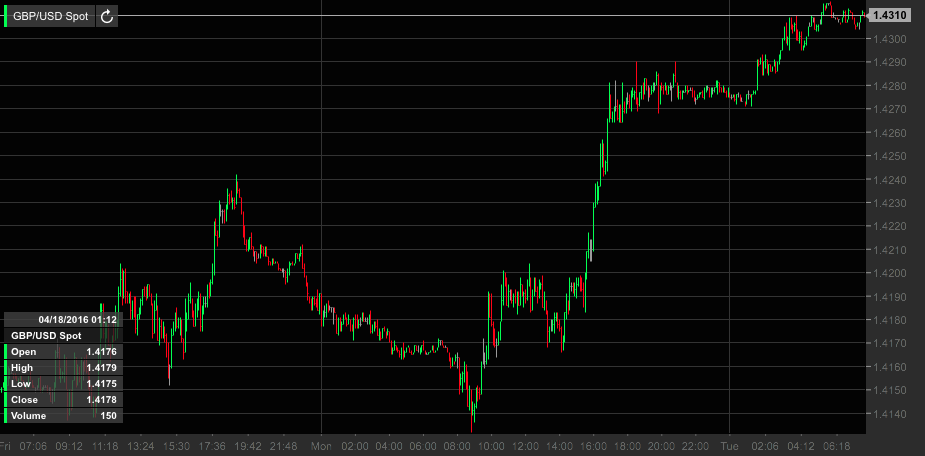

Opposite movement for the Cable which is trading positive at the moment at 1,4310 (+0,22%) after having touched the Asian session high at 1,4316. The Sterling in extending his recover against the Greenback for the 3rd consecutive session starting from the 1,4100 low on the back of the risk-on sentiment prevailing the market.

Possible reasons for the Sterling price actions are related to the speculations of the Brexit pool: following the Telegraph’s ORB pool the “remain” side will win while, following a treasury analysis on the UE referendum, the Brexit possibility would cost more than £ 4.300/year for every household.

Meanwhile the GBP Economic Calendar is pretty empty, the most relevant event will be the BOE governor Carney speech while looking at other countries, relevant events for the Sterling crosses would be the US housing data and the German / Euro-Zone ZEW surveys.

Looking at the charts of the two crosses we can see some interesting levels:

the EUR/GBP cross seen to the downside could find the next significant support at 0,7853 after which the pair could have no reasons not to go to the 29 March low at 0,7825.

Regarding the Cable it is not excluded a test of the 1,4391 resistance which could be a good level to short the pair waiting for a correction.